Why a Turnaround Beats Insolvency in 2025: An Insider’s View

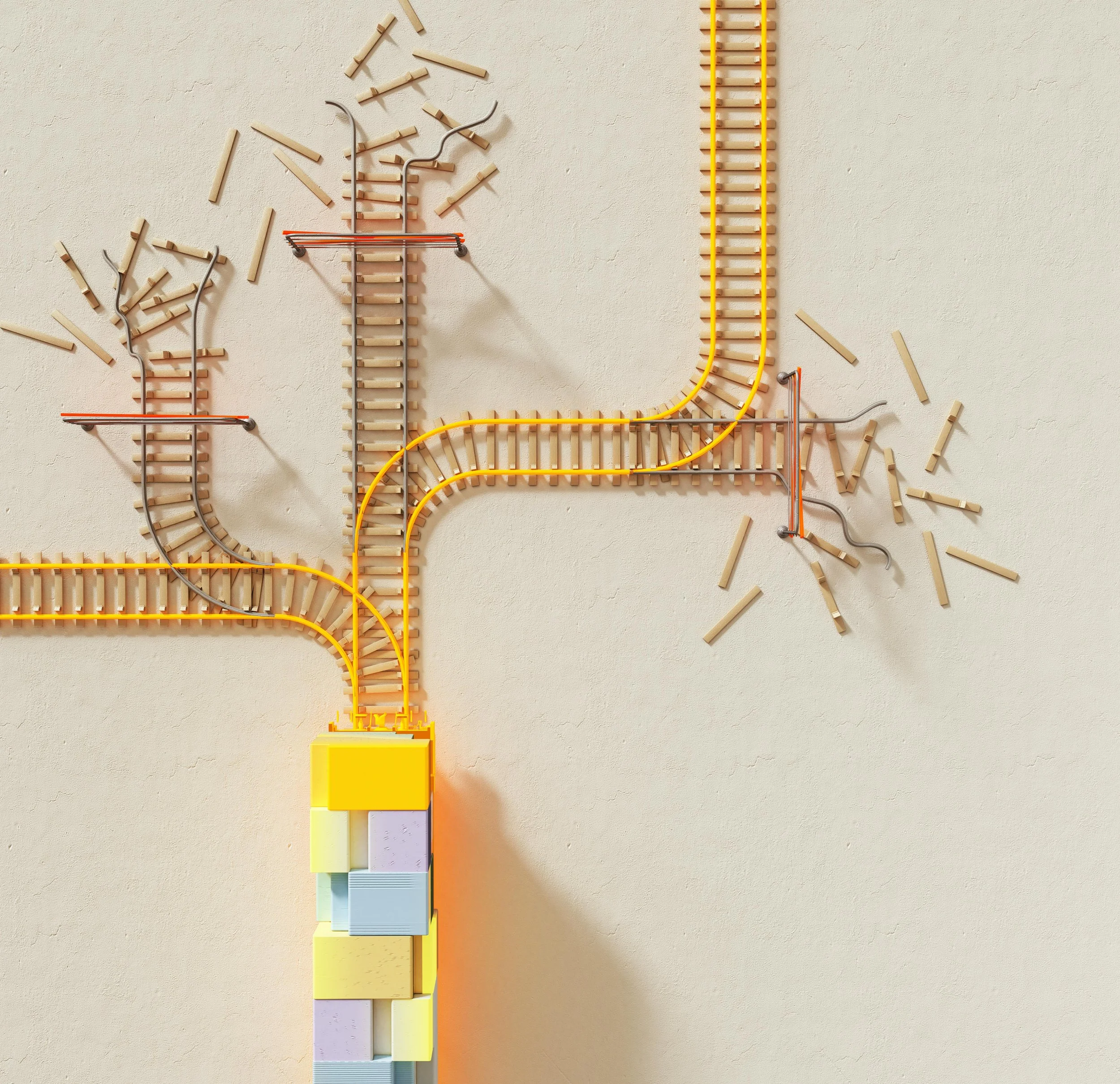

After years of economic turbulence, high interest rates, and shifting consumer behaviour, many businesses are once again facing a familiar crossroads: fight for a turnaround or surrender to insolvency.

In 2025, the answer has never been clearer. The smartest move for most struggling businesses isn’t to go under — it’s to turn around.

The turnaround profession has evolved dramatically over the past decade. What was once seen as an emergency measure has become a sophisticated discipline, supported by data, technology, and modern legal frameworks. Today’s turnarounds are faster, more analytical, and more human than ever before — and they’re saving companies that would once have been written off.

The new landscape of business rescue

Corporate insolvencies in the UK have reached their highest levels in more than ten years. Yet, this wave of distress has also driven innovation in how companies are saved.

London, in particular, has become a global centre for business rescue, thanks to its flexible restructuring frameworks — including Company Voluntary Arrangements (CVAs), restructuring plans, and pre-pack administrations. These mechanisms allow viable businesses to reset their structure and finances while preserving operations, customers, and jobs.

In short, they protect the “going-concern” value — the contracts, people, and reputation — that would otherwise vanish in liquidation. This value preservation is what makes turnaround a fundamentally more sustainable strategy than insolvency.

Turnaround preserves real business value

When a company enters liquidation, value disappears almost instantly. Assets are sold off in isolation, employees scatter, and customer trust evaporates.

A turnaround, by contrast, focuses on stabilising operations and restructuring obligations while keeping the business alive. It protects the very elements that generate value: people, customers, and cashflow.

Reports from leading restructuring firms such as Alvarez & Marsal and Teneo show that businesses which undergo structured turnarounds can deliver 20–40% higher recoveries for creditors compared to those entering formal insolvency. The logic is simple — it’s better to fix and trade than to dismantle and sell.

Jobs and relationships matter more than ever

Beyond numbers and balance sheets, a turnaround protects something far more valuable: trust.

A successful restructuring keeps people in work, sustains communities, and maintains relationships with customers and suppliers. Jobs are not just a social benefit — they’re a commercial asset. Retaining the workforce and the culture behind it allows a company to rebuild quickly and sustainably.

Research published by Harvard Business Review in 2024 underlines the importance of leadership and communication during corporate recovery. Employees who feel informed and involved become part of the solution, not part of the problem. Morale, when managed properly, becomes a strategic asset.

It’s faster — and often cheaper — than insolvency

Many directors assume insolvency is the quicker fix, but the opposite is often true. Formal insolvency processes can drag on for months or even years, eroding value along the way.

A disciplined turnaround can stabilise a business in 90 days and complete major restructuring within six months. By maintaining operational continuity, it avoids the massive loss of value and reputation that accompanies shutdowns.

Pre-pack administrations, increasingly common in the UK, illustrate this advantage. When executed transparently, they provide speed, continuity, and certainty — key elements in any successful recovery.

Private credit and rescue capital have changed the game

Five years ago, distressed businesses often had nowhere to turn for funding. That’s no longer the case.

The rise of private credit funds, specialist turnaround investors, and alternative finance providers has opened new avenues for companies in distress. These investors see potential where traditional lenders see only risk. They provide liquidity to bridge cashflow gaps, fund restructuring costs, and even invest in growth initiatives during recovery.

This influx of rescue capital has made turnaround a realistic, even attractive, option for viable businesses that might otherwise have faced collapse.

Technology and AI are transforming turnaround strategy

Perhaps the most profound shift in 2025 is technological.

Digital tools, data analytics, and AI have transformed how turnarounds are planned and executed. What once took weeks of manual analysis can now be done in days — or even hours.

Real-time cashflow dashboards, AI-powered pricing models, and operational analytics pinpoint problems with precision. They identify where costs can be cut, where margins can be improved, and where processes can be automated.

Modern turnaround teams operate more like business surgeons — diagnosing, prioritising, and correcting inefficiencies with surgical accuracy. The combination of human leadership and digital intelligence is what gives modern turnarounds their edge.

The modern turnaround mindset

The difference between failure and revival often comes down to mindset.

Successful turnarounds are led by people who combine data discipline with human leadership. They create rhythm — daily cash reviews, weekly priorities, transparent communication. They replace panic with structure.

This philosophy reflects the growing professionalisation of the turnaround field. Organisations such as the Turnaround Management Association (TMA) have helped formalise best practices and establish global standards of ethics and performance. In 2025, turnaround isn’t an act of desperation — it’s a strategic business tool.

When insolvency still makes sense

Of course, not every company can or should be saved. If a business model is fundamentally broken — if the market has disappeared or technology has made the product obsolete — insolvency may be the responsible route. But in most cases, businesses fail not because they are unviable, but because they act too late. The key is early action. The earlier a company engages a turnaround specialist, the more options it has. Waiting until cash runs out or lenders lose patience dramatically limits the scope for recovery.

The 2025 case for choosing turnaround

Turnaround is proactive. Insolvency is reactive. A turnaround is about designing a future, not managing a funeral. It’s about strategy, leadership, and innovation. In 2025’s complex economy — where resilience and agility define survival — turnaround isn’t just a recovery tool. It’s a growth philosophy.